Market Munch 🍎| July 10 2022🚀

The G7's ambitious plan to bring down Russia's oil revenues unravels, Sri Lanka's on fire (literally), and Elon finds out that Twitter can hit back.

Good morning Munchers!

Here is your daily dose of the news that will help you sound smarter at parties - In 6 minutes and 23 seconds.

Let’s dive in.

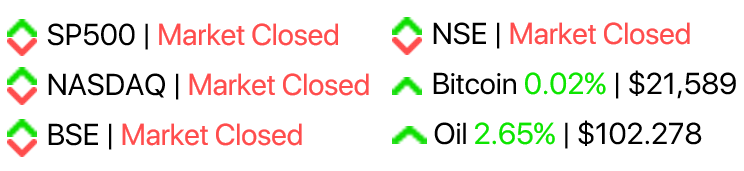

What’s hot, what’s not

Market Commentary

Crypto bros get a little breathing room as total crypto market cap begins flirting with $1 trillion level.

US employment numbers sky-high and unemployment is steady, indicating a red-hot labour market.

Short sellers start exhausting and ease off the pressure as US stocks push out flat to moderate green days.

Story Roundup

1 - A breakdown of the G7’s battle plan against Russia - and everything wrong with it🛢️🧨🔥

The G7 countries have set a lofty target for themselves - to prevent Russia from making money off their “war of aggression” while limiting economic damage to the world.

Russia’s offences into Ukraine have sent global energy prices soaring - which hurts businesses, governments and consumers. That’s everyone.

So Mr. Biden has put forward an admittedly ambitious plan to stop this from happening.

It’s called “Mission Price Cap”.

It works by bringing together every key consumer of Russian oil and working with them to bring the price down.

The problem? Countries like India and China have been buying heavily discounted oil (think $30/barrel because of preferential treatment) while the rest of the world grapples with prices north of $100/barrel.

It’s not a free lunch - but it sure is a cheap one. Obviously, India and China are filling their bellies with it - having upped oil imports from Russia by almost 10 times.

This isn’t a tried-and-true method - and most analysts say that we’ll need a Hail Mary.

Doesn’t look like we’re having relief at the petrol pump anytime soon.

2 - Sri Lankan PM quits as the country flirts with collapse

“There is no government that cannot be overthrown by an empty dinner table.”

Such words were perfect testament to the raid of Sri Lanka’s presidential residence yesterday.

They literally set fire to the place.

Throngs of people began protesting after Sri Lanka’s economic ruins left the country’s foundations in ruin.

As COVID swept the world, a lot of their domestic industries were hit hard by supply crunches. As a result, the government banned fertilizer imports so that the country’s foreign exchange reserves maintained intact. (imports need to be bought in foreign currency)

But local fertilizers didn’t do as well - and crop failures meant that food inflation over the country slowly crept to 57%.

Combine a failing economy with sky-high inflation and an “incapable” government, and you have the perfect recipe for disaster.

3 - Elon’s been served ⚖️

Word on the street is that Twitter is willing to go to war for an acquisition. And it’s an uphill battle for Elon.

Any guesses as to where this battle is going? The US Courts.

The dramatic story of Elon Musk’s $44bn buyout of Twitter has been highlighted by two stark differences in two leaders.

On one hand you have the brash and assertive Mr. Musk, and on the other hand you have the diplomatic and tactful Parag Agrawal.

Reports from inside the company say that Agrawal is swinging back more and upping the ante on an already long and drawn out battle.

Elon Musk’s offer to acquire Twitter at $54.20 per share now stands at a 47% premium from the last closing price. He surely doesn’t want to splash out any more billions than he has to.

Behind closed doors however, their juxtaposition seems to cease - as they both agree on key things like -

revenue diversification

relaxation of moderation rules

audience building

This one is a fight for the history books. 📚

4 - US Labour markets have muscles. GIANT ones. 💪

Employers in America hired about 372,000 people last month, compared to forecasts of 272,000.

Sounds great - but it’s important to note that employment is a lagging indicator of recession.

Strong employment means that central banks need to be more hawkish - since you need to slow the labour market down to control inflation.

What does this mean? Cue more rate hikes, possibly larger in magnitude.

What we’re seeing is a slow weakening from a strong place. Consensus is that the ‘speed’ of weakening won’t increase.

Reminder - the Federal Reserve needs to tap the brakes, but tap them slowly enough that we don’t flip over.

The economy needs to be tightened, but not enough to put us into a recession.

Let’s hope that JPow is confident in the drivers’ seat.

5 - Faith in central banks slowly chips away 🔒💣

For the better part of a century, central banks have been controlling markets from behind the scenes.

Everyone knows what their general job is - to control the economic cycle of boom and bust with the help of interest rates and quantitative easing.

The prosperity of most central banks has coincided with an era of high inflation - apparently backing up their prudence at managing economies.

Things are changing.

Central bankers around the world have faced a lot of criticism at “criminally” lax monetary policy - leading to an unsustainable ‘everything bubble’ - and an even scarier implosion of said bubble.

The Fed hasn’t been kind to risk assets at all - and their hawkish advances are exactly what proves this.

Investors used to believe central banks would rescue them — now they worry the banks might bury them.

Check out https://www.brrr.money - all I’m saying.

Aaaand that’s a wrap!

Thanks a ton for reading. Any feedback is open - positive or negative. Hit my line at aryaansh.rathore@gmail.com or https://www.linkedin.com/in/aryaansh/.