Market Munch 🍔| July 16 2022

Biden hits the reset button on Saudi ties, Celsius's hot water starts to boil, and recession fears hammer commodities.

Good morning Munchers!

Here is your daily dose of the news that matters, from Wall Street to Dalal Street - in 5 minutes and 47 seconds.

Let’s dive in.

What’s hot, what’s not?

Market Commentary

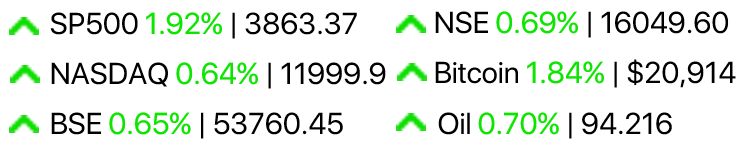

US stocks climbed higher as the Fed calmed markets down - and the 100bps hike is increasingly looking like it’s off the table. 🤦

Indian markets broke a 5-day losing streak, as volatility calmed. Seller exhaustion led to a flat session.

Markets shifted back to pricing in a 0.75% rate hike from the Fed after some reassuring inflation surveys. Maybe it’s not as bad as we think it is. Maybe. 🤫

Story Roundup

1 - Biden fist-bumps his way into the Saudi good books. ⚔️🛢️

Today morning Joe Biden dropped into Riyadh to repair ties with the Saudis - a country that he famously once threatened to turn into a “pariah”. (Read = outcast)

It looks like he’s ready to risk it all to tame inflation.

One of the main targets from this meeting is to get the Saudis to raise oil production to bring energy prices down.

It’s simple economics - more supply, means a lower price.

Why Saudi?

KSA and UAE are the only two countries with sufficient spare oil production capacity - and it looks like forgiving and forgetting never hurt anyone.

2 - What’s got 11 chapters and no money in the bank? 🥵

When asked about the $1.2bn sized hole in his company’s balance sheet, here’s what the founder of Celsius Network blamed.

“Poor investments” and “unanticipated losses”

In a 61-page court filing, the skeleton of the extinct lender Celsius was laid out - with just $4.3bn in assets and $5.5bn in liabilities.

Celsius had to pause withdrawals of it’s users - effectively locking $4.7bn of money and making it inaccessible. (forever)

The biggest things that screwed them over -

- Astronomically bad bets

- Horrible market conditions

- Mismanaged asset deployment

- (as a result) Failure to grow sustainably.

I won’t be surprised if we see a Fahrenheit Network that offers double Celsius’s rates.

Just a personal heads up. If you see a project that's offering you 18% returns every year for doing nothing, don't walk. Run from it.3 - Strong retail sales and calmer expectations push markets up. 📈

A happy end to a disappointing week is all we could ask for - and the markets delivered.

Retail sales in the US rose by 1% - showing the Fed and the rest of us that consumer demand hasn’t completely evaporated.

What the newspapers don’t talk about is the frustration behind this - people aren’t spending more because they want to. People are spending more because they’re forced to.

With inflation at 40-year highs and no signs of a reduction in cost-of-living, total expenditure went up. How can you tell? The biggest drivers were gasoline and automobiles.

The ‘smart money’ has eased off the inflation trigger - and it looks like short-term inflation expectations have receded for the meanwhile.

A 75bps hike is more favorable at the next Fed meeting over the 100bps that was being floated after the 9.1% CPI print.

God bless America.

4 - Copper market routed as recession fears hamper commodities. 🪙

Copper - the world’s most important industrial metal - hit it’s lowest level since 2020 as the sparks of a recession find their way into markets.

Benchmark copper contracts slipped 1.6% to $7,000 over weak economic data from China.

The narratives for metal markets have shifted to a dark tone - aggressive tightening by central banks around the world will hit demand for copper hard.

Couple this with COVID lockdowns in China and lower activity in Europe over gas supply concerns - and it’s not difficult to see why the metal is down almost 35% from it’s all-time highs.

Goldman (typically a bullish player when it comes to commodities) cut it’s copper forecasts - calling to the table “increasingly pessimistic growth expectations”.

Balancing on a knife’s edge.

5 - Britain’s public sector gets a 5% pay raise. 💸🫰

Boris Johnson seems to be hell-bent on proving that he isn’t the worst thing to happen to the UK (since GCSEs) - so he just offered 5% pay raises to all public sector workers.

Wages for the public sector currently cost taxpayers about £220bn - so that’s an extra £11bn going out.

The problem?

People are pissed. One of the biggest unions in the UK argued that there could be hundreds of disputes if workers had to “pay the price of inflation themselves”.

Health officials shared this thought - “A pay rise less than inflation won’t be enough to persuade disillusioned health workers to stay in the NHS.”

UK Inflation currently stands at a 40yr high of 9.1%.

Let’s hope they can wrap it up well.

Aaaand that’s a wrap.

Thanks a ton for reading. Any feedback is open - positive or negative. Hit my line at aryaansh.rathore@gmail.com or https://www.linkedin.com/in/aryaansh/.

Well encapsulated analysis. As they say, keeping on shining.