Market Munch🍦| July 17 2022

Biden gives Saudi oil a boost, traders rack up bets against the Euro, and 10-minute delivery shows that it can burn investor money just as fast.

Good morning Munchers!

Here is your daily dose of the news that matters, from Wall Street to Dalal Street - in 5 minutes and 40 seconds.

Let’s dive in.

What’s hot, what’s not

Market Commentary

Wall Street and the rest of the world have an earnings season to look forward to - along with some key macro events. 27th July is when the US Fed drops their rate decisions. Eyes peeled.

D-Street (that’s India😉) indices defended some key levels. It looks like most of the selling is exhausted, and the waves of vol are finally coming to rest.

Markets are favoring a 75bps hike - with a 70% chance that will happen. There’s also a 30% chance of the 100bps hike.

Story Roundup

1 - US gets Saudi to (fist) bump up their oil production. 🇸🇦🇺🇸

Yesterday Biden bro-ed out with MBS (the Crown Prince of SA).

The reason behind the US President’s trip to the Middle East is subtle but simple - to tame aggressive inflation back home.

Oil prices have surged since the start of the year - wreaking havoc on the Average Joe’s bank account and leading to widespread misery at the gas pump.

If Saudi raises production - oil prices will take a hit as more supply means a lower price.

And it looks like Mr. Biden was successful - MBS announced that he’d increase the Kingdom’s oil production from 11m barrels/day to 13m barrels/day.

Oil’s on one slipper slope. 😬🛢️

2 - 30 minute grocery delivery in China - a $3bn implosion. 🛒

A year back, Chinese 30-minute grocery startup Missfresh delighted investors after raising money at a $3bn valuation from the big boys. (Tiger Global, Goldman Sachs, Tencent)

Hit the fast forward button, and they lose 97% of their value - sitting at a mere $88m market cap as of yesterday.

The company is fighting for it’s very survival - wallowing in a mess of accounting scandals, employee resignations and loss of growth.

It’s a simple strategy - cover a target city with a ‘blanket’ of micro-warehouses - containing essentials that rotate shelves quickly.

The problem? It burns a MASSIVE hole in your pocket. Cash flow is drying up at insane rates and the company is being pressured to delist.

Missfresh has definitely turned stale. 🤮

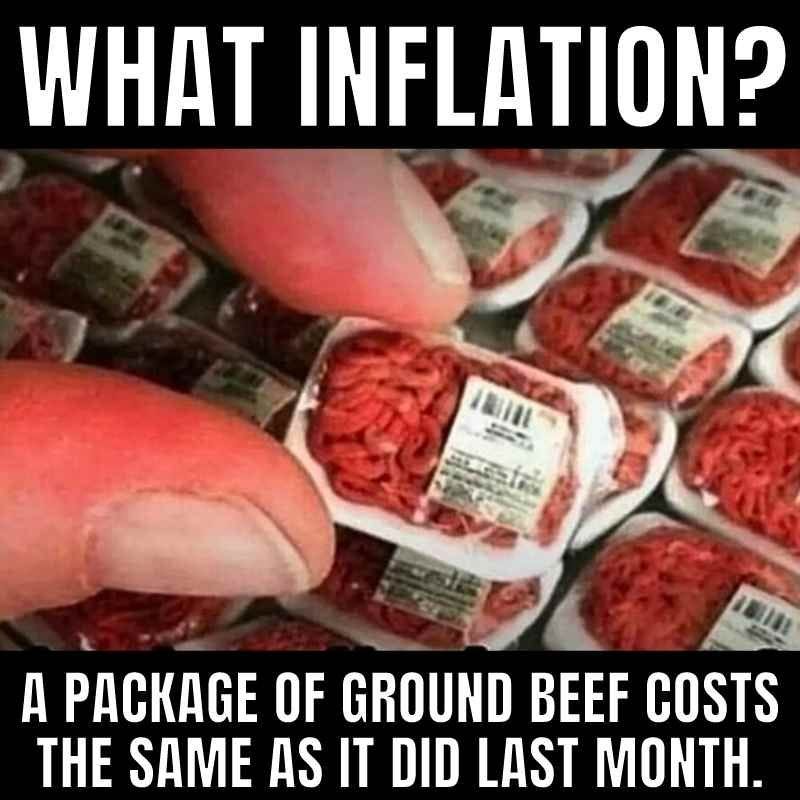

3 - Fuel prices are coming back down - it’s food we need to worry about.

There is not a single government that cannot be overthrown by an empty dinner table.

Agricultural inputs like oil and petrol-based products led to a rout in crop yield. Expensive input means farmers can afford less of it - which gives you less output.

Energy is calming down now - which means that the agricultural ‘inputs’ are now lower, right? Nope. Food prices are still stubbornly high, often carrying CPI up in a lot of countries.

The cost of fertilizer globally has almost doubled over the last few months - which means that lesser fertilizer is being used.

The result? Lower quality crop.

Lower supply, same demand. More money chasing lesser things. Price? Goes up.

People are hungry - and it’s the duty of global central banks to make sure that no one goes hungry.

4 - Venture capital and it’s reconciliation with reality. 💸

2020 and 2021 were some of the most phenomenal years for VCs. An environment swamped with liquidity and jam-packed with innovations happening left-right-center.

And VC money flowed into all sorts of hot stuff - 10 min delivery, Web 3.0, and BNPL (Buy now, pay later) to name a few.

A year on?

Most BNPL companies are down 80-95%. Most 10-min delivery startups are bankrupt and on life support. Most crypto bros are now HODLing simply because it hurts to look at BTC’s price.

VCs felt the brunt of this. SoftBank’s Q1 profit was down 96% from a year before, and Tiger Global’s tech investments turned sour - with the hedge fund posting a +50% YTD.

If history is any guide, it’s that the investments made now are the ones that will post the craziest returns. Venture money invested and held during sober periods historically yields a higher return than money invested during periods of disillusionment.

“Be fearful when others are greedy, and greedy when others are fearful.” - Warren Buffett 🙏

5 - Investors pile on Euro selloff as recession fears spiral. 💶

The European Union’s economic outlook is darkening - and analysts are betting that the Euro will keep tumbling.

It’s already dropped 12% this year against the US Dollar, after being hammered by -

- soaring commodity prices

- a Russian invasion of Ukraine

- possible cutoffs of gas supply

- a widespread cost of living crisis

- a whole lot more

The question isn’t about whether a recession is going to happen - it’s about how bad a recession will get. The bloc’s energy woes are set to cement for the worse during the winter months, where each member needs to stockpile at least 80% of gas supply. Not many are near that number.

It’s time for the ECB to pick a poison - soaring inflation or the threat of recession

Aaaand that’s a wrap.

Thanks a ton for reading. Any feedback is open - positive or negative. Hit my line at aryaansh.rathore@gmail.com or https://www.linkedin.com/in/aryaansh/.