Market Munch 🍕| July 18 2022

Starbucks's UK segment is brewing something, Elon Musk wants to drag the Twitter trail out, and warnings roll in about semiconductor margins.

Good morning Munchers!

Here is your daily dose of the news that matters, from Wall Street to Dalal Street - in 5 minutes and 40 seconds.

Let’s dive in.

What’s hot, what’s not

Story Roundup

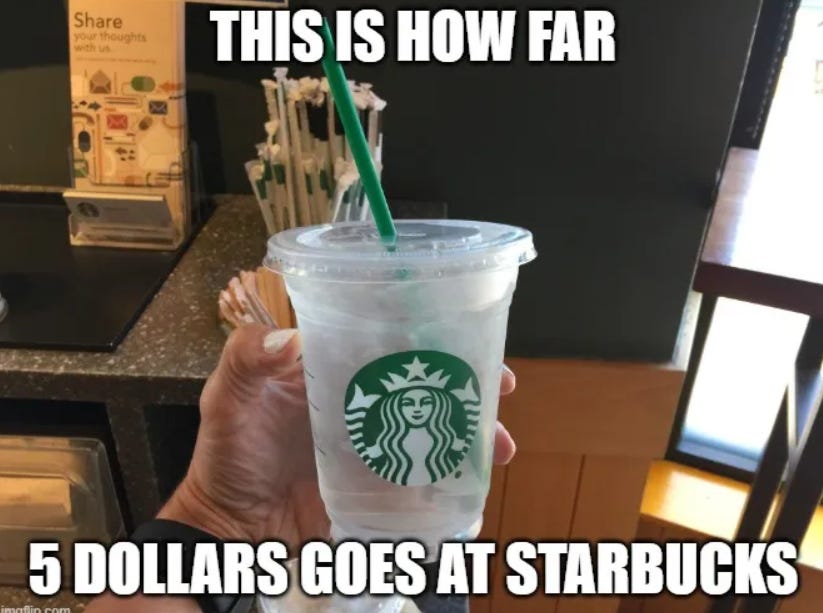

1 - Starbucks considers saying bye-bye to UK business. ☕

In the CEO’s words - “it got hammered during COVID and never came back since.”

Starbucks has had a difficult time since the pandemic, and adapting to changed consumer tastes has not been working well.

Instead, they are sitting on a business that barely squeezed out a profit margin of 3.5%. For 2021, and was loss-making a year before that.

It’s getting hard for Starbucks to compete with the rest.

Takeaway chains like McD’s and Burger King are focusing on coffee discounted with a meal - which hurts Starbucks in comparison. After all, why spend $8 on just coffee when you could get a small meal with it?

They own 1,000 stores in the UK - 700-or-so of which are franchises, and the rest of which are owned by themself.

Looks like something’s brewing. �

2 - Semiconductors still strong, but profit in question. 💻

Semiconductors are used in almost everything - from computers, to cars, to washing machines.

And TSMC (Taiwan Semiconductor Company) - one of the biggest boys on the block - is warning about inflation pressures.

During their earnings call, they left us with two takeaways.

1 - Revenue will continue to grow.

- Semiconductor manufacturing inputs are more expensive now

- The final product will be more expensive now.

- Demand for semiconductors is inelastic - so top-line numbers will go 🆙.

2 - Profit might get hurt.

- Semiconductor manufacturing inputs are more expensive now.

- That’s it. 😏

Electrifying.

3 - Musk wants to take Twitter for a walk in the park. 🚶

Twitter is angry about Musk backing out of their deal at the last minute - and they want to get a court to enforce the acquisition.

Elon knows that a long, drawn out legal battle will hurt Twitter and put downward pressure on an already underperforming stock - but so does they.

Ergo, Twitter asked to start their trial in September - which is a month or so from now.

Elon said no. He want s a trial in February 2023 by the earliest. That’s more than half a year out.

US courts have a history in siding with the seller when it comes to forced acquisition.

Let’s see whether Mr. Musk’s hand will be forced.

4 - UK trains won’t go choo-choo. 🚂

It’s been 30 years since the last co-ordinated industrial strike by train drivers - but it looks like they’re planning one more.

The reason?

A cost-of-living crisis. Train drivers are understandably angry over not being paid in line with inflation, so they’ve decided to go on strike over it.

Inflation hurts the poorest most - as wealthier people tend to have the spare 5-10% to pay for more expensive goods and services.

One of the largest rail unions announced a strike on the 27th of July - vowing to continue the strike “for as long as it takes”.

Looks like it’ll give the rest of the world something to learn from.

5 - Central banks warmly welcome big hikes to tame inflation. 📉

A survey by the FT found that central banks are choosing for large rate rises now, more than any time this century.

The Fed put down their first 75bps hike since 1994 - which sent the US Dollar higher against other currencies - the DXY (tracks the dollar) is up almost 17% this year.

Reason is simple - saving in USD will yield a higher return than saving in, say EUR will. So investors might sell some EUR for USD to capture this extra yield.

This is pressuring other countries to start hiking rates. The last thing any country wants in a time like this is a weak currency. Canada was the first on the bandwagon opting for a full 100bps hike.

It’s definitely an interesting period for global markets.

Aaaand that’s a wrap.

Thanks a ton for reading. Any feedback is open - positive or negative. Hit my line at aryaansh.rathore@gmail.com or https://www.linkedin.com/in/aryaansh/.