Market Munch 🍔| July 21 2022

Tesla profit surges as they overcome all sorts of problems, Indian govt cuts a lot of oil taxes, and FTX wants to shuffle the US derivatives market up.

Good morning Munchers!

Here is your daily dose of the news that matters, from Wall Street to Dalal Street - in 5 minutes and 3 seconds.

Let’s dive in.

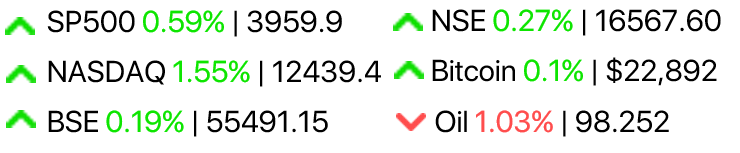

What’s hot, what’s not?

Story Roundup

1 - Tesla profits overcome supply chain shock and production turmoil. ⚡

The perfect way to sum up Tesla’s earnings comes from their CFO.

“We have so much excess demand that the economy is not an issue for us.”

Tesla’s net profit jumped 57% for the quarter. Their total revenue also rose 42% from this time last year to a mind-boggling $16.9bn.

They also revealed that they sold off most of their $1.5bn in Bitcoin - converting about 75% of it to fiat in the wake of tumbling crypto markets.

Tesla has managed to brave all sorts of disruptions and still managed to come out on top -

- China lockdowns (no production in China factories)

- High costs of setting new plants up

- Commodity inflation (cost of production goes up)

Electrifying. 🔋

2 - FTX wants to change the way that futures are traded. 🤑

Crypto exchange FTX wants to shake things up - in a big, big way.

They just asked for approval from the US Securities and Exchange Commission to offer their clients Bitcoin futures.

If they’re successful - it’s a ruling that could change the mechanics of derivatives markets that are used by everyone - from farmers to hedge funds.

Say you levered up on GameStop, and the trade went against you.

A normal broker would issue a margin call. Put up more money, or they’ll close the trade.

FTX wants to do the opposite - automatic liquidation.

The graphic below explains the nitty gritty.

Interesting times. 🤔

3 - A scorching European nightmare puts pressure on the energy market. 🛢️

There’s an extreme heatwave in Europe, and it’s causing a lot of bad things.

- Heatstroke, and a lot of heat-related deaths in the EU.

- Wildfires all over Europe with a lot of important green area lost.

- Melting roads. Literally.

But the one that will probably have the most impact - energy pressure.

Summer is usually meant to provide some release for the European energy market. The weather gets pretty pleasant, and not many are using heating (obviously) or cooling (because the weather’s nice).

But record-breaking temperatures have led to soaring demand for power - as people need a lot of relief from the extreme heatwave hitting the EU.

Looks like we’re definitely feeling the heat.

4 - Ukraine asks to suspend debt repayment. 💸

Ukraine’s been hit by a lot of things - invasion from their neighbors, soaring food prices, a weakening economy - and most recently, a budget deficit running at $5bn a month.

To plug this, the UK, US and Germany announced that payments on Ukrainan debt could be suspended till the end of 2023 - and they encouraged private bondholders to do so too.

This will help the Ukrainian government save about $6bn over the two years that they’ve pushed back.

However, in most people’s books, a dept repayment suspension is considered as a default.

Not this time.

French officials say that this sort of debt management is “not a default at all” and that they were confident over full repayment from Ukraine.

That’s another history book rewritten this year. 🤔

5 - India cuts oil tax just 3-weeks after imposing it. 🫰

The Indian government provided some relief to oil-and-gas companies by cutting some newly-imposed taxes.

Gas export tax - 6Rs/Litre → 0Rs/Litre

Diesel export tax - 12Rs/Litre → 10Rs/Litre

Aviation-fuel tax - 6Rs/Litre → 4Rs/Litre

Domestic crude oil - 23,250Rs/Ton → 17,000Rs/Ton

Local oil producers saw a jump in stock price -

Reliance +4.3%

Oil India +8.8%

Oil and Nat-Gas Corporation +6.8%

Vedanta +4.3%

Happy days. 🙏

Aaaand that’s a wrap.

Thanks a ton for reading. Any feedback is open - positive or negative. Hit my line at aryaansh.rathore@gmail.com or https://www.linkedin.com/in/aryaansh/.