Market Munch 🍔| July 23 2022

The ad-industry loses $80bn of value, Russia and Ukraine agree to be buddies with T&Cs, and crypto-bros start getting hounded by the law. ⚖️

Good morning Munchers!

Here is your daily dose of the news that matters, from Wall Street to Dalal Street - in 5 minutes and 1 second.

Let’s dive in.

What’s hot, what’s not?

Market Commentary

Earnings took center stage as a miss in Snap’s earnings dragged the entire market down, with tech-heavy Nasdaq down 1.8%.

Business confidence measures seem to be cooling - with the PMI falling to 47 (more on this later)

Russia’s central bank cut rates from 9.5% to 8% in a surprise mega-move in response to rapidly improving inflation and GDP outlook. 💪

Story Roundup

1 - Ad-heavy stocks get jolted over Snapchat earnings disappointment. 📉

Snapchat profits came in WAY under expectations - and dragged most of Big Tech down.

Yesterday, about $80 billion in market value was incinerated from ad-reliant companies. This includes your household names - Meta (-8%), Google (-6%) and Pinterest (-14%).

“Forward looking visibility remains increasingly challenging” - their words, verbatim.

This was reflected in their profits - declining about 180% year-on-year to $422m. This blew analyst expectations of $340m out of the water.

To fix this, Snap’s decided to “substantially reduce” hiring, shake up it’s strategy ASAP, and cut spending to as low as is humanly possible.

Reckon they’ll be able to snap back? 📸

2 - First steps toward regulating crypto made. 🐂

The latest development in the regulation of crypto? Some altcoins ARE securities.

What does that mean?

You can get in trouble for insider-trading them. With criminal charges. 😬

The US SEC recently charged 3 crypto-bros for trading altcoins before they went public on Coinbase.

One of these guys worked AT Coinbase - so he had access to material, nonpublic information on which coins were due to be listed in Coinbase.

In the world of shitcoins and altcoins - listing on a big exchange usually means a big pump in price.

Well, Mr. Coinbase and his cronies accumulated a position in the coin before listing, and immediately dumped after they were significantly richer.

In total, about $1.1 million richer.

The lawsuit is here if any of you are law nerds that also happen to be crypto bros.

3 - “A beacon of hope on the Black Sea” - Russia’s ceasefire. ⚔️

Mr. Putin’s got another side quest aside from ownership of Ukraine - he wants to prevent a global food crisis.

Ukraine and Russia just struck a deal that has the aim of averting a global food and cost-of-living crisis.

It’s more or less a ceasefire on a few ships - which will pull up to Ukrainian ports, collect millions of tonnes of stranded grain, then get out of there.

This increase in global grain supply will bring some breathing room to some of the most vulnerable people in the world, most of whom are on the edge of famine.

Ukraine is the world’s 4th largest grain exporter - and the World Food Program expects the Russia-Ukraine conflict to push about 47mn people into hunger.

The aim? to return to prewar grain export levels.

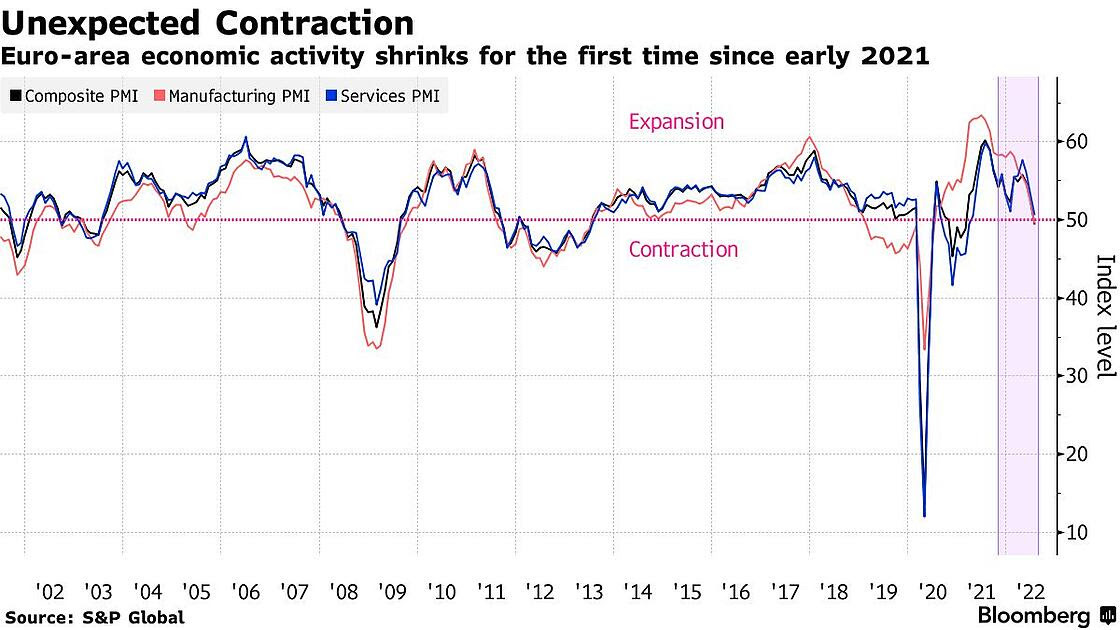

4 - Europe’s facing a recession? 😓

Figures out yesterday signal that Europe has a recession on their hands.

A survey of purchasing managers called the PMI (Purchasing Managers Index) dropped to a 17-month low, and dropped below the 50 level - which signals a contraction.

The PMI is important because it’s seen as a pretty accurate indicator of business conditions.

And what it’s currently telling us is that business conditions might not be the best. 💀

This downturn in manufacturing is also accompanied by service-sector growth going more-or-less flat if not declining, as discretionary spending gets hammered.

Looks like a pretty bad omen for the rest of the world 🤔

5 - The Pakistani Rupee suffers it’s worst weekly tumble over default fears. 😥

Pakistan’s currency had it’s worst week in over 20 years - over concerns that they might be the next ones to follow in Sri Lanka’s footsteps and default on foreign debt.

The PKR tumbled 7.6% yesterday to 228 Rs/1 USD.

Concerns are mounting that last week’s $1.2bn loan from the IMF may not be enough to hit the brakes on a balance-of-payments crisis.

Pakistan’s forex reserves are down to $10bn from $16bn a year back, which is just over one month’s worth of debt repayments.

Fragility in Emerging Markets after Sri Lanka’s default has rattled currencies of other South-Asian countries too. India’s currency is at $80/USD, up from $70/USD just a year and a half back.

Fingers crossed that this doesn’t turn awry. 🤞

As a popular Pakistani economist said - “There are many outside powers who want to avoid an outright disaster in Pakistan created by an economic collapse.”

Aaaand that’s a wrap.

Thanks a ton for reading. Hope you enjoyed it. Any feedback is open - positive or negative. Hit my line at aryaansh.rathore@gmail.com or https://www.linkedin.com/in/aryaansh/.