Market Munch🍎| July 26 2022

Walmart sets markets on fire, Russia finally cuts gas flow and India's $14b 5G auction heats up.

Good morning Munchers!

Here is your daily dose of the news that matters, from Wall Street to Dalal Street - in 4 minutes and 27 seconds.

Let’s dive in.

What’s hot, what’s not?

Market Commentary

Retail stocks got battered after-market, as Walmart dropped some very scary guidance.

Shares of top Indian companies also fell over a lot of estimate misses.

The US Fed reports their changes to the benchmark interest rate tomorrow at 4:15PM NY Time. A very helpful fed-watch tool is here.

IMPORTANT EARNINGS RELEASES TODAY -

- UPS, COCA-COLA, GENERAL MOTORS, GENERAL ELECTRIC, 3M GROUP, MCDONALDS, RAYTHEON TECHNOLOGIES all before market open.

- MICROSOFT, GOOGLE, VISA, CHIPOTLE all after market close.Story Roundup

1 - Walmart warning sends stock price plunging. 🛒

The world’s largest company by revenue lost 10% of it’s market value last night.

According to the CEO, the rampant food and fuel inflation “is changing how customers spend”.

Overall impact on them?

They estimate that their operating income will be down up to 14% this year.

In response, their stock (NYSE:WMT) tumbled almost 10% - the biggest loss one-day drop since 1987.

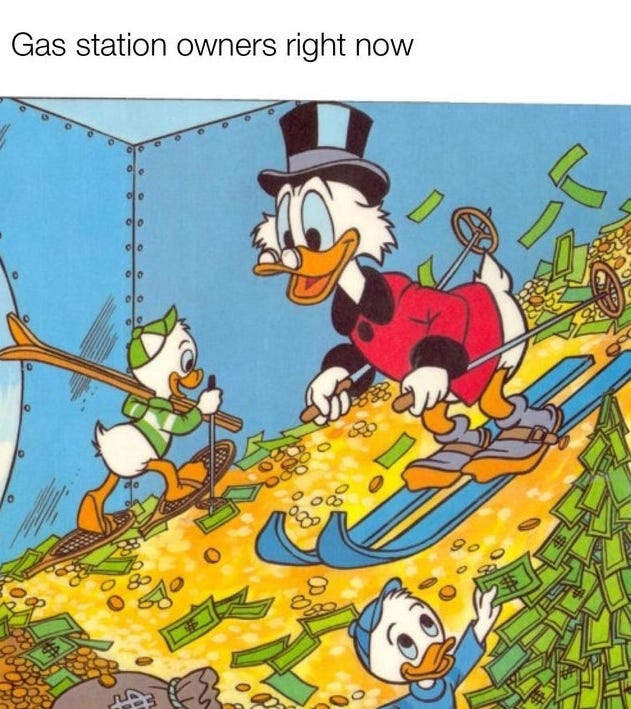

2 - Russia cuts gas flow to Europe. ⛽

On Wednesday, a Russian pipeline that supplies Europe with 40% of their gas will have it’s flow capacity cut to 20%.

While Russia is adamant that this cut was caused by technical problems, European energy officials think otherwise.

Their explanation is that Russia’s restricting flow to retaliate against European sanctions imposed after the Ukraine invasion.

Gas prices shot up 10% after this news broke.

Relief at the gas pump is still quite far out. 😮💨

3 - Amazon blames inflation after Prime price hike. 🆙

Amazon Prime members in the biggest European countries will find themselves paying anywhere from 30-45% more for their one-day-delivery.

These are Amazon’s steepest increases to date - and they blame inflation.

The world’s biggest ecommerce business attributes these price hikes to soaring costs of retail, overstaffing during the pandemic recovery, and a LOT of supply chain crunches.

Prime members are important to Amazon as they often spend more than often, but the price of offering 1-2 day delivery has skyrocketed. (fuel, packaging, salaries - all up big.)

Amazon (AMZN:NASDAQ) was down 5% after-hours because of Walmart’s crap earnings.

4 - Black-market dollars more popular than ‘white’ ones in Argentina. 📉

The average Argentinian person barely has any confidence in the economic system. They have to deal with -

official inflation at 100%

domestic debt increasing to unseen levels

political dogfights

Most have lost confidence in their local currency - and trade their hard-earned pesos to US Dollars on the black market.

The last time we saw a gap this big, it was during the hyperinflation meltdown of 1980-90.

Sign of the times.

You can read more here.

5 - India’s $14b 5G airspace auction attracts the richest. 🗼

Ambani’s Reliance, Adani’s Adani Group and Sunil Mittal’s Airtel will all be bidding for Indian 5G frequency rights.

It’s an auction that could decide the future of the digital space as most Indians know it.

Adani has never tread directly on Ambani’s feet until now - with Adani Networks’ surprise entry to the super-important 5G auction.

People are trying to map out India’s richest man’s telecom ambitions - who has confirmed that he will not be directly in competition with Jio.

Looks like time will tell where this one goes. 🤫

Aaaand that’s a wrap.

Thanks a ton for reading. Hope you enjoyed it. Any feedback is open - positive or negative. Hit my line at aryaansh.rathore@gmail.com or https://www.linkedin.com/in/aryaansh/.

Thanks for reading Market Munch! Subscribe for free to receive new posts and support my work.